Transport and Freight Index

June 2020 Transport and Freight Index Report

Release Date: June 2020

Logistics downside at its worst..with a small but...

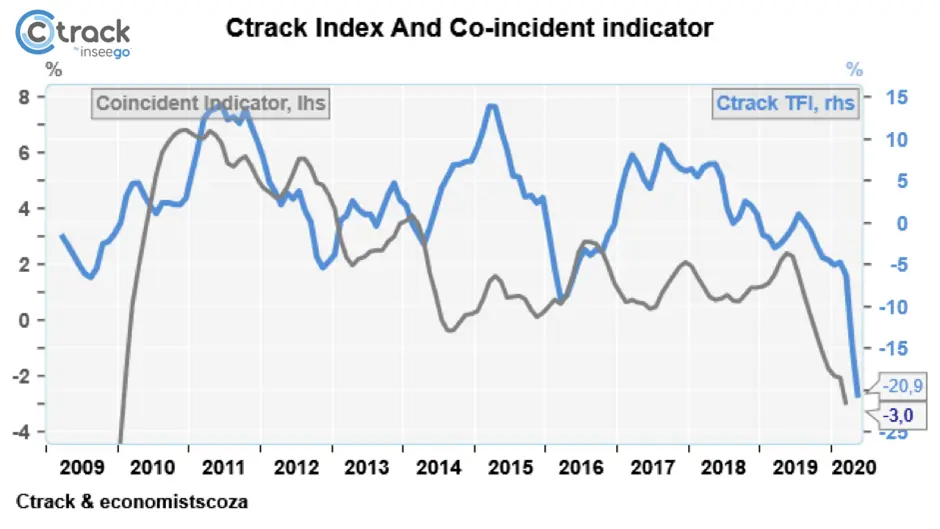

South Africa’s logistics industry experienced its worst monthly volumes since records began, according to the latest Ctrack Freight & Transport Index.

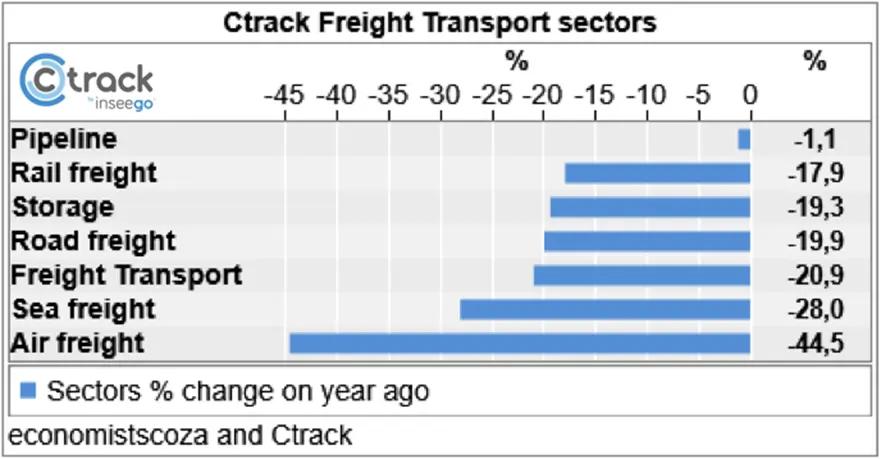

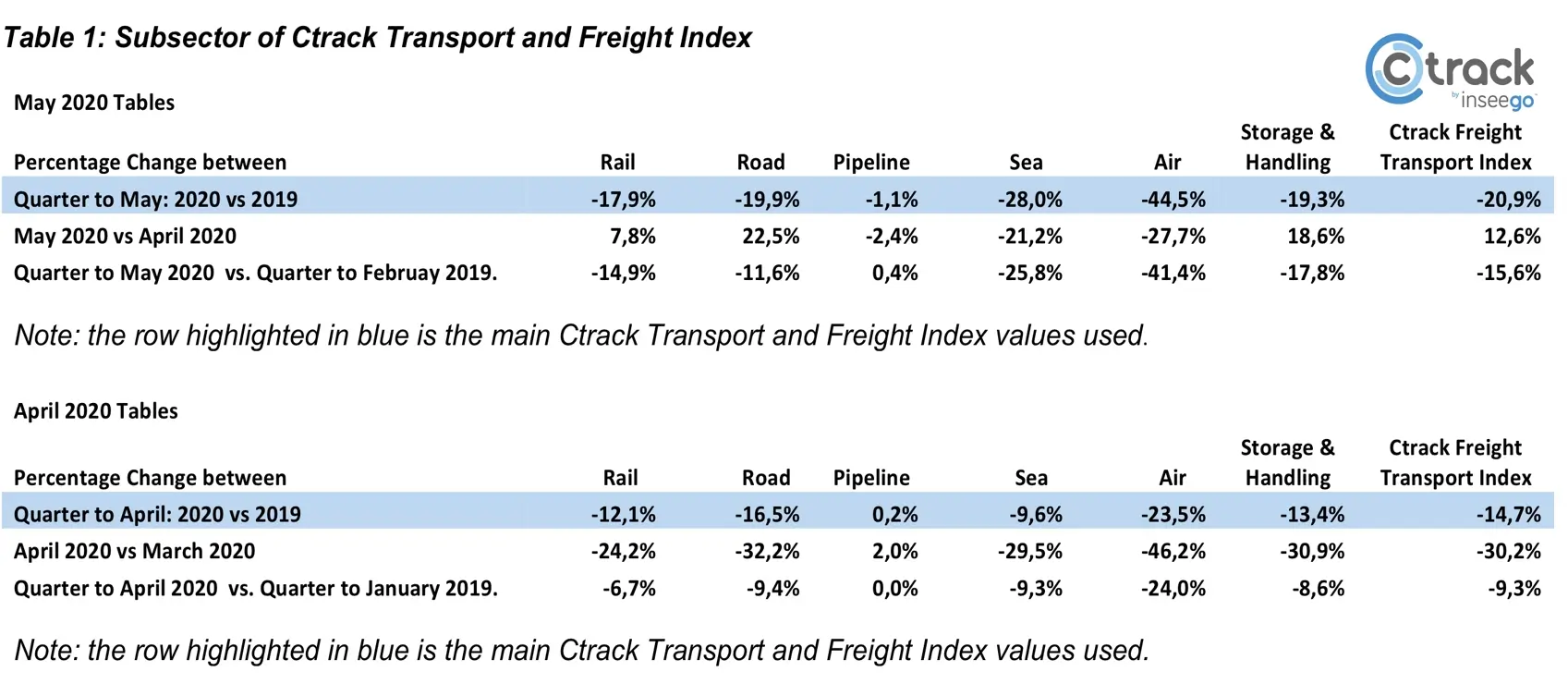

With a 20,9% decline compared to the same month a year ago, the volume of goods transported and stored in the country dropped by over one-fifth during the month.

However, the biggest volume drops shifted away from local land-based transport to international transport, and both SA’s rail freight and road freight volumes showed signs of recovery.

In fact, both road and rail freight, as well as storage volumes, increased compared to April’s levels. The recovery in these sectors was realised as the country shifted from level 5 to level 4 lockdown restriction.

The local transport sector has probably seen the worst, while international trade remains in the midst of the Coronavirus crisis.

The air freight sector needs to open up as soon as possible. It is clear that many air freight companies and freight forwarders in the sector will not survive, while important exports such as flowers, table grapes, and even Harrismith’s apples continue at snail’s pace.

The air transport sector - both passenger and freight - may not return to pre-Covid-19 levels for three years.

IATA estimates the sector will make losses of $84,3 billion this year having already lost $419 billion in revenue. Between January and July, 7,5 million scheduled flights were canceled worldwide. Non-scheduled air freight is down over 80% in some countries.

In a normal year, air freight transports over 52 million metric tons of cargo - about 35% of all global trade by value. In SA, some respite is expected by the end of July as international flights ramp up. But clearly, air freight is the hardest hit sector in transport.

The good news is that, apart from air freight, the worst is now behind us and the governments of the world are working quickly to reopen their borders. Air freight volumes should see major improvement by August.

Pipeline volumes in SA are likely to disappoint in the short term. While volumes were up last month, large-scale thefts and damage to infrastructure have impacted the industry negatively.

Perhaps the biggest question for transport and logistics service providers is when will normal trading conditions return. We believe road and rail freight volumes will get close to normal in the next three months or so.

Sea freight volumes may take up to the end of the year to normalise.

Air freight however needs scheduled passenger flights to resume fully. That may take a few years as Covid-19 infection fears linger on.

“Normal” logistics volumes may mean 95% of the old normal for a while. Complete economic recovery needs time and we will have to be patient to regain the last 3% to 5%. The new normal should be good enough though for most transporters to compete and win back market share.

The old normal for local land transport volumes may only be realised by the end of next year though. But, like all recessions, the first part of the bounce back is expected to be quick. It is the last part that always takes the longest. That is the nature of the business cycle.

Storage of high-value goods, such as mobile phones and gold will increase fairly quickly. Moreover, some goods such as fresh fish, which is often flown up from the coast, is going to be moved via road. So, the road freight sector may benefit from the modal shift, along with parts of the storage sector in the interim.

While the May 2020 Ctrack Transport and Freight Index numbers are disappointing, we are seeing green shoots in the supply chain environment. Transporters need to get ready for a return to “normal” in much of the logistics industry from next month.

“While air freight volumes remain a major concern, we can see there is some light at the end of what has been a very dark tunnel,” comments Hein Jordt, managing director of Ctrack South Africa.

“People around the world have shown tremendous courage and resourcefulness during this unprecedented global pandemic. We are encouraged and remain hopeful that the logistics industry, like many others, will eventually return to some level of normalcy sooner rather than later,” he concludes.