Transport and Freight Index

October 2021 Transport and Freight Index Report

Release Date: 29 October

Ctrack Freight Transport Index decline over the 3rd quarter

International transportation of goods remains under pressure.

International supply chain problems and local attacks on the logistics infrastructure have had a negative impact on the entire transport sector during the 3rd quarter of 2021.

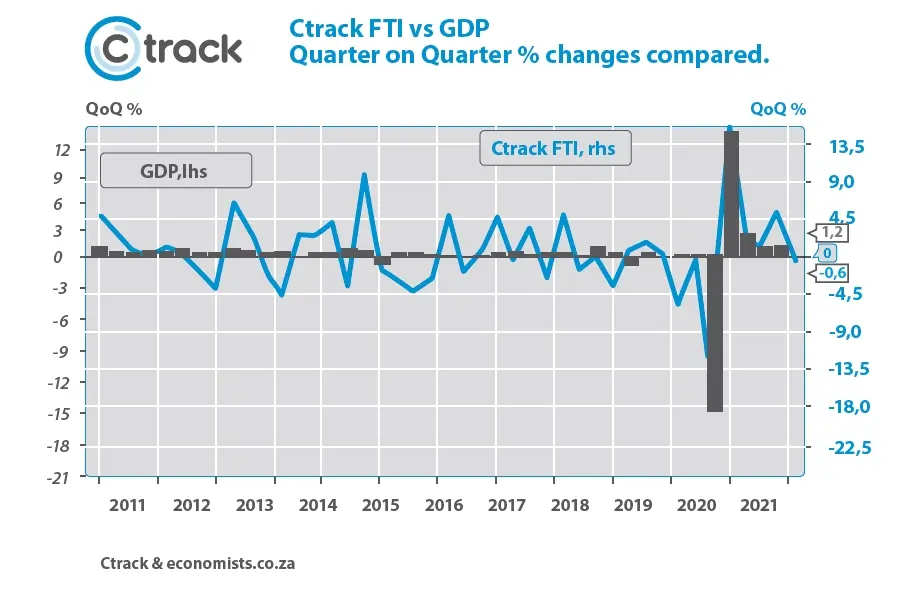

The Ctrack Freight Transport Index declined by 0,6% compared to the previous quarter. This decline will most likely be reflected in the overall 3rd quarter GDP, which is due to be released in early December, as transport is a co-incident indicator.

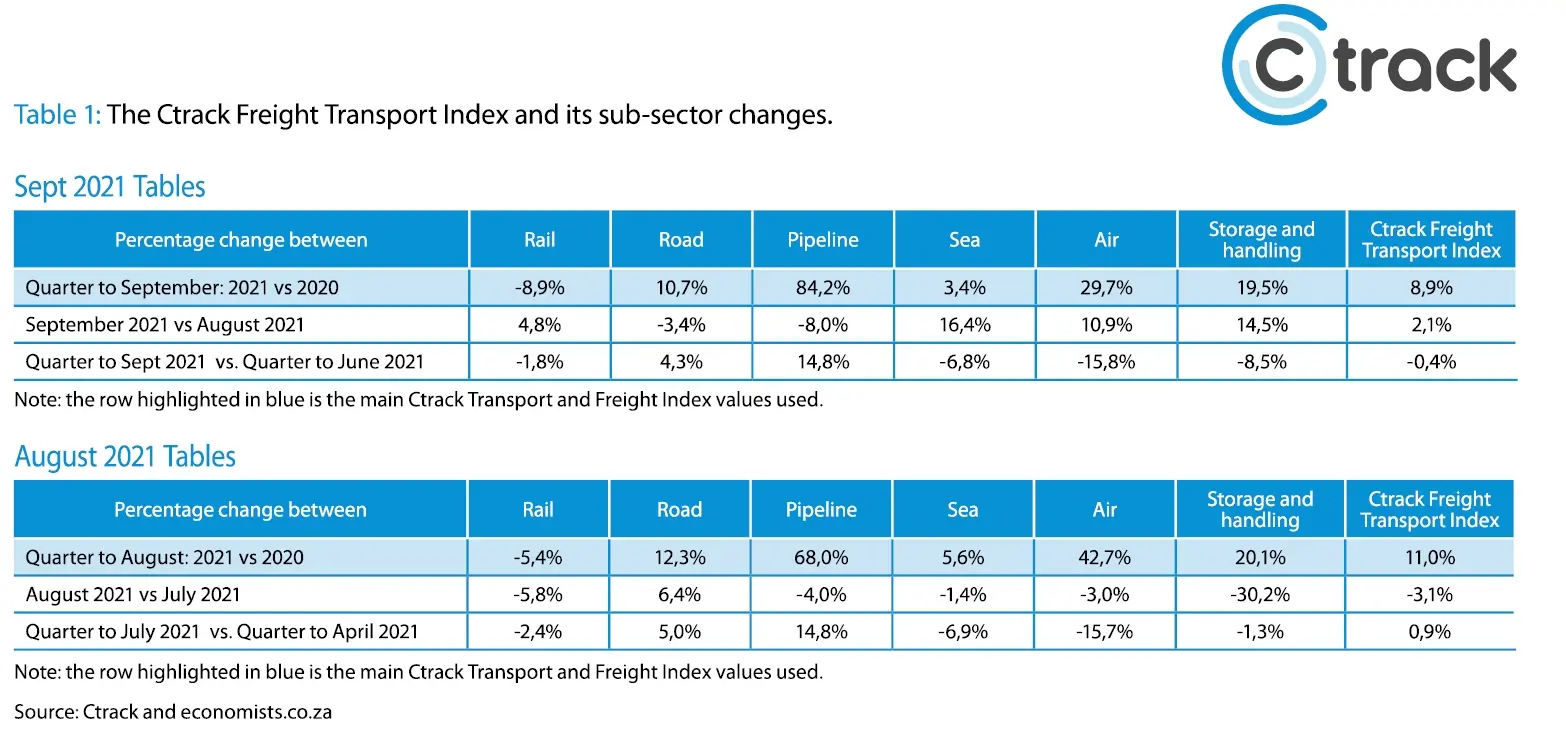

While the increase on a year ago is a very respectable 8,9% (but down from an adjusted 11% the previous month) for the whole industry, one must not forget the low base that this represents as South Africa was then bouncing back from the multi-decade lows experienced during the 2nd quarter of 2020.

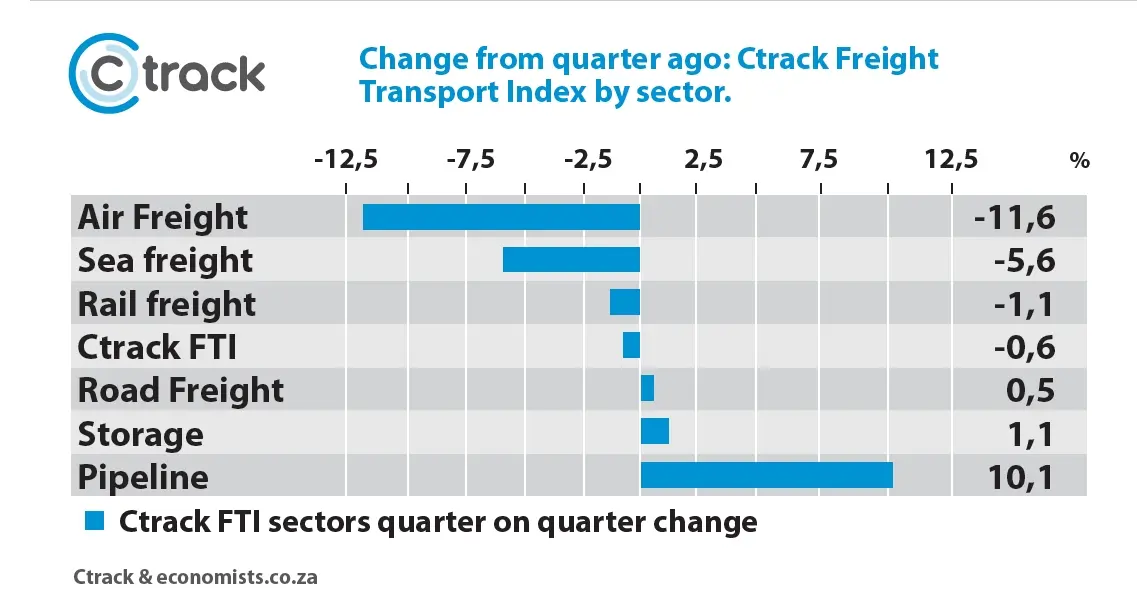

The world’s supply chain breakdown is clearly visible in the decline of Air Freight and Sea Freight. As the main methods of transport in the global supply chain, the declines in these sectors were to be expected. It is no longer strange to hear of ships that are delayed for over five weeks as they need to wait for freight to be loaded and then again when they need to offload at their destination.

Air Freight declined by 11,6% while Sea Freight declined by 5,6% in the 3rd quarter. The latest speculation reveals that wealthier industrial nations are using cargo planes to help relieve the pressure on the ports and assist critical manufacturers awaiting components.

Since the start of the COVID-19 pandemic, the impact on Air Freight and international passenger transport has been immense. It is expected that normality will only return in 2023.

Complex product manufacturing has been the hardest hit by these supply chain disruptions as solving one supplier shortage exposes the next product shortage. Some factories are literary a stop and go situation which causes further delays downstream.

Graph 1: Quarter-on-quarter change in the Transport sectors.

South African transport sectors are under pressure from criminal elements.

While the international portion of the Freight Transport Index clearly displays the global supply chain delays, on the local front, there are numerous additional problems surfacing and resurfacing.

“The onslaught on business in the transport sector is relentless, with supply chain and criminal elements the biggest contributors to stunting any possible growth. To top that all, a massive fuel price hike is also imminent. It is in times like this that a business simply cannot operate without a dedicated tracking and fleet management partner that has eyes on your moveable assets, 24/7,” says Hein Jordt, Managing Director of Ctrack SA.

South Africa continues to experience attacks on infrastructure. Recently Transnet reported the theft of 130km of cable in the four weeks ending on the 22nd of October. This is in addition to another 322 incidents of damage to infrastructure such as actual rail, signals, stations, and level crossings.

The Road Freight sector too remains under attack, with reports of at least 22 trucks being destroyed during the month of October. Damage to pipelines causes regular delays in that sector, while frequent leaks in the main pipeline between Durban and Gauteng mean that contractors have been appointed on a permanent basis to clean up fuel spills.

Furthermore, unexplained fires in some Ports show that the Transport sector is very vulnerable to sabotage.

Much of the infrastructure coming under attack is outside populated areas or cannot be seen from populated areas or busy routes. The closing of cases and successful conviction of perpetrators is dismal as witnesses are hard to find, and the perpetrators slip away too often. At the same time, lives are also lost in the industry.

Given the aforementioned circumstances, the relatively small decline in the Ctrack Freight Transport Index is an achievement and shows the industry's resilience. Road Freight continues to gain market share as Rail Freight struggles against the cost increases from reverting back to diesel locomotives and signal problems.

While Road Freight did decline over the last month, it remains close to its all-time high and increased with 0,5% during the 3rd quarter. However, every transport sub-sector is feeling the impact of the unusual concertina effect created by the global supply chain disruptions.

The strong positive change in pipeline volumes reflects the low base of the 2nd quarter as the oil and fuels in storage were most probably enough at that time not to require more to be pumped. This shows that the Petrochemical industry is also experiencing its own supply chain hiccups.

The 10,1% increase compared to the previous quarter, on the eve of a massive fuel price hike, indicates that many users are filling their tanks ahead of these expected increases.

“While fuel price increases affect every industry, one of the most effective ways to keep an eye and manage fuel usage is through a bespoke driver management system of which Ctrack is the market leader,” concluded Jordt.

Storage increased a moderate 1,1% for the 3rd quarter.

Graph 2: The GDP seems to follow the Ctrack FTI